Tool Box W-2 is an easy to use tax preparation software for the filing of forms W-2 and W-3.

TBW2 makes the process of preparing all your client's forms W-2 and W-3 easy and straight

forward. Includes all these features and more:

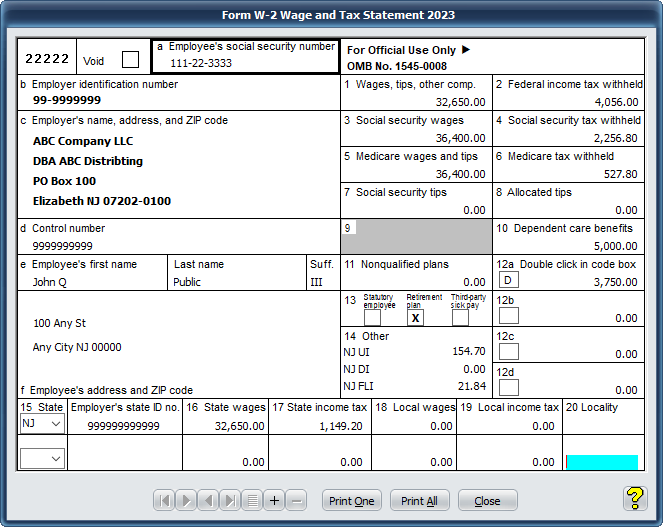

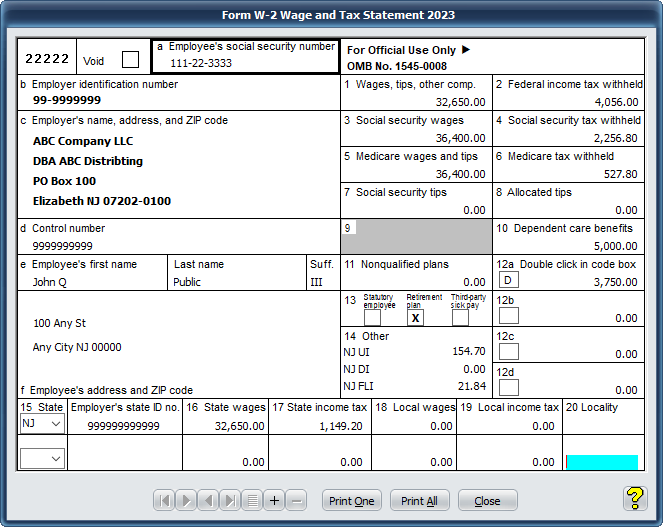

Ease of Use and Time Saving. The learning curve on this program is nil. As soon as you

load TBW2 you will be up and running. There are just 2 data entry screens to keep track of;

the W-3 and W-2 data entry forms. As soon as you create your first client file, the program

will automatically display the W-3 data entry form, just complete a few required fields and

then go on to the W-2 data entry form. This form has the look and feel of a real form W-2,

and from this one data entry form you create, edit, navigate, and delete employee records.

you can also print all or one form from within the Form W-2 data entry screen.

Payee Labels: You can print payee address labels. The program supports Avery® 5160 address

labels. With this type of label you can print up to 30 payees on a single sheet. Also, the program

will automatically print the Post Net Bar Code of any payee whose "City, State and Zip Code" field

contains a Zip+4 Zip Code format (XXXXX-XXXX).

Fast and Efficient File Database: For speed and efficiency, file read/write is accomplished by

using low level Windows API calls, also, the file records are manipulated using a binary format for

super fast reads and writes.

— What's New for 2026 —

Added Box 14b to Form W-2, "Treasury Tipped Occupation Code" which is a requirement due to the passage of the

OBBA. Also, a list window has been added which displays a list box of Treasury Tipped Occupation codes, from

where the user can select a code number.

Added Eight (8) additional code fields within box 12 on Form W-2. Although there are now 12 possible codes within

box 12, only the first 4 codes (12a through 12d), will be printed on the Form W-2, the remainder (12e through

12l), is for use by the EFW2 module. See the program's help file for additional information.

NOTE: Support for the red pre-printed copies of Forms W-2 and W-3 was discontinued in 2025. Users should

instead use the program generated Black and White Copy A which has been approved by the Social Security

Administration.

The initial program release (Version 2026.00), does not inlude support for printing and filing black-and-white

copy A of Forms W-2 and W-3 for 2026. As soon as they are approved by the Social Security Administration (SSA),

the Program will be updated to support them.

Price: $45.00

To download a TBW2 demo click here

home |

products |

support |

purchase |

search |

downloads

Copyright © 2026 HJP Associates, Inc. All Rights Reserved

19141 visitors since June 1, 2000

|