|

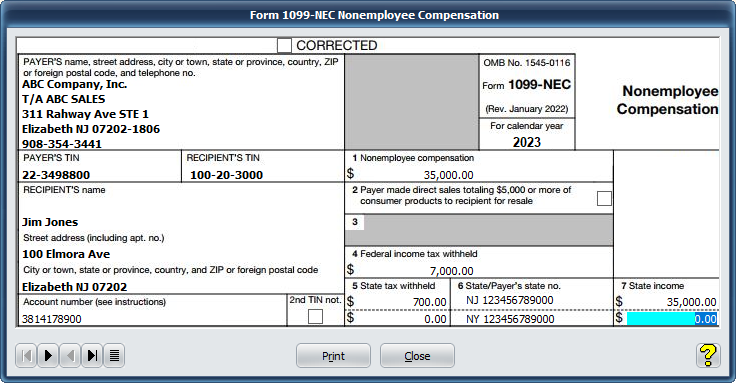

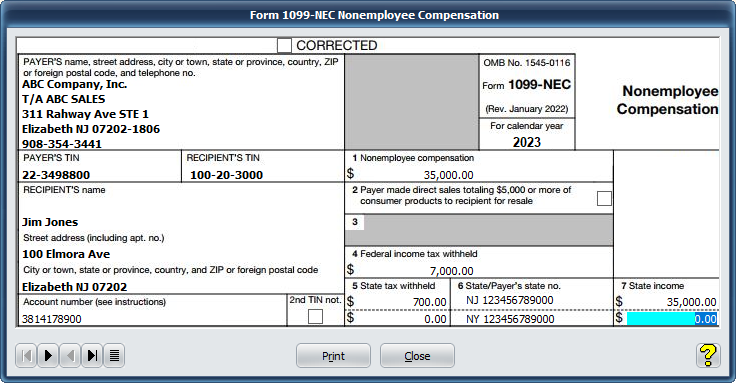

Tool Box 1099 is an easy to use tax preparation software for the filing of forms 1099 and 1096. TB1099 makes it a snap to prepare Internal Revenue Service (IRS) business information tax returns. The program supports the following features:

Version 2025.01 includes support for printing and filing the IRS red pre-printed forms. Printing tip for the IRS red pre-printed forms. Every effort has been made to ensure the proper print alignment of the forms. In our test printer we have determined that placing the forms in the printer's tray instead of the auto feeder produces much better results. For example, in our test printer we place the form with the print side facing down and forward in the tray, however, your printer might be different and you will have to determine your printer's document printing orientation, we recommend printing on marked scrap paper to do this. — What's New for 2025 — Form 1099-MISC Box 14 (Excess golden parachute payments) has been eliminated. Form 1099-NEC has a new Box 3 for the reporting of Excess golden parachute payments. Form 1099-R Box 7 has a new Code "Y" for reporting Qualified charitable distribution (QCD) claimed under section 408(d)(8). A check box has been added to all the Forms to manually enter an "X" in any necessary check box on the form. When checked, the program will not cause an "X" to print within any check boxes. Applies to the IRS Red Pre-Printed Copy Only. Price: $49.00To download a TB1099 demo click here home | products | support | purchase | search | downloads

Copyright © 2025 HJP Associates, Inc. All Rights Reserved |