|

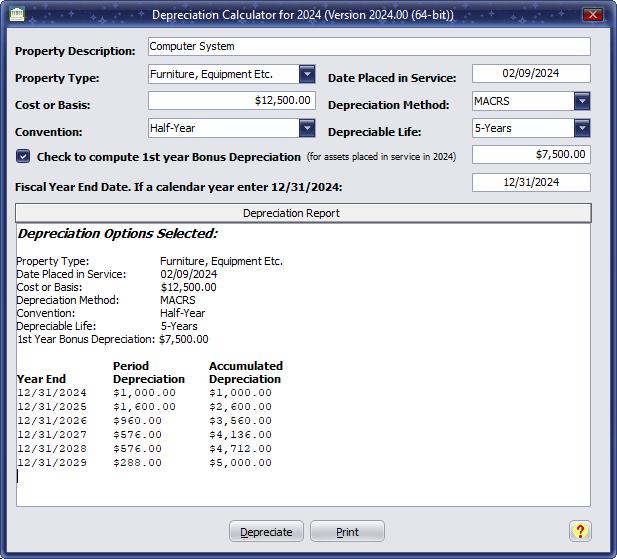

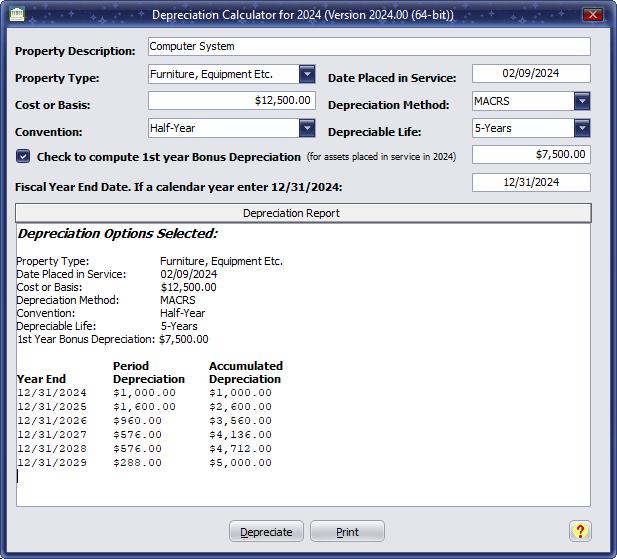

Depreciation Calculator is not a fixed asset manager, however,

it will assist you in managing your fixed assets.

Property Types Supported:

- Furniture and Equipment.

- Passenger Automobile

- Van, Light Truck, or Sport Utility Vehicle

- Heavy Truck, Truck-Tractor

- Residential Real Property

- Non-Residential Real Property

Depreciation Methods Supported:

- Modified Accelerated Cost Recovery System (MACRS)

- Straight-Line

Conventions Supported:

- Half-Year

- Mid-Quarter

- Mid-Month

Depreciable Lives Supported:

3-Years, 5-Years, 7-Years, 10-Years, 15-Years, 20-Years, 27.5-Years, and 39-Years.

Fiscal Year Support:

The program will compute the applicable depreciation by comparing the date the property was placed in service

with the fiscal year ending date.

1st Year Bonus Depreciation Computation Support:

The program will compute the 100% first year bonus depreciation for all qualified property types placed in

service after January 19, 2025, otherwise, 40% will be computed for assets placed in service prior to

January 20, 2025.

Features:

The Date Placed in Service field automatically determines the quarter in which the property was

placed in service (if using Mid-Quarter convention), or the month (if using Mid-Month

convention), to ensure that the proper depreciation rates are used. Also, for luxury automobiles, the

program will use the proper Internal Revenue Service (IRS) tables based on the year placed in service.

The Date Placed in Service field has another little trick, double click it or press the "C" key

on your keyboard and a calendar will pop-up to assist you in entering the correct date.

Double clicking within the Cost or Basis field or pressing the "C" key on your keyboard will

summon the pop-up calculator. The pop-up calculator is capable of retrieving amounts from the Cost or Basis

field as well as putting amounts back from the calculator.

The display window only displays the property's year-by-year depreciation.

Use the print command button to print a Depreciation Report (Registered version only).

Export Depreciation Reports to Adobe Portable Document Format (PDF) and Web

document (HTML) from within the print preview screen (Registered version only).

Depreciation Calculator comes equipped with a very informative help file (

view it), to assist you in completing the

Depreciation Options.

Pay for it once and receive an update every year. Every registered user will be entitled to a free update

each year at no additional cost.

Price: $20.00

To download a Depreciation Calculator demo click here

home |

products |

support |

purchase |

search |

downloads

Copyright © 2025 HJP Associates, Inc. All Rights Reserved

15103 visitors since December 6, 2007

|